Fraud Detection through Visualization

Using diagram visualization techniques to identify and highlight fraud schemes in graph and network data

What is Fraud Detection?

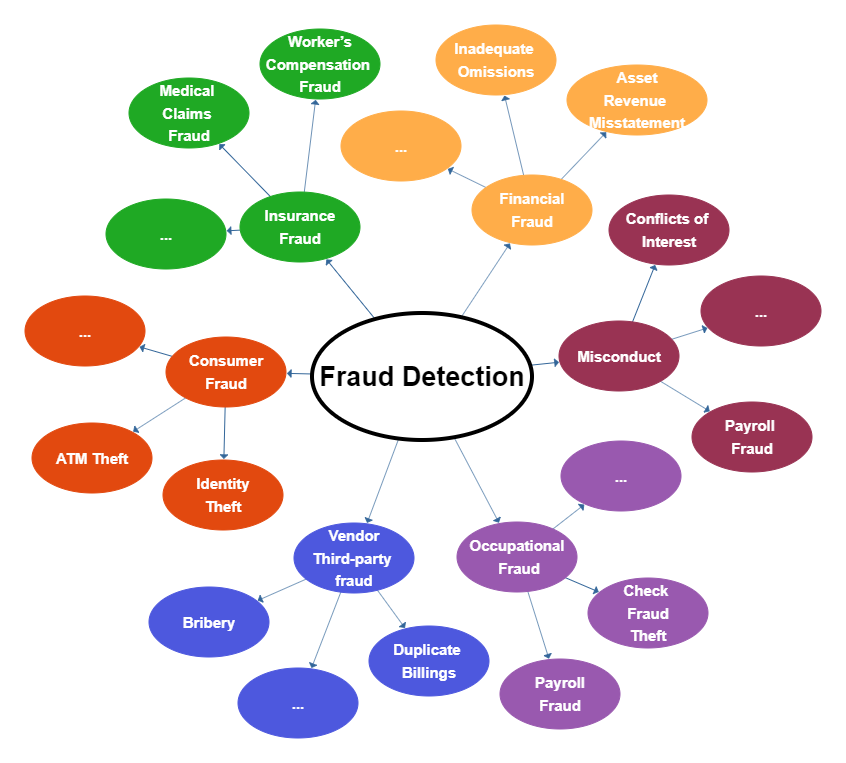

Fraud refers to the abuse of the assets of an organization, company, or person to make a profit. Depending on the relation of the fraudster with the company, fraud is either called internal or external. Internal fraud refers to the fraud committed by someone inside the company, while external fraud refers to fraud by outsiders. The most important fraud schemes include financial fraud, client/consumer fraud, occupational fraud, health-care/insurance fraud, vendor/third-party fraud, or misconduct.

Many companies worldwide become victims of fraudsters even though most of them tend to believe that fraud is something that “could not happen to them”. In general, most fraud cases are not identified immediately, but only after remarkable damage has been caused. Unfortunately, this damage does not limit only on a severe economic loss but also invokes other liability issues towards clients, employees, financial institutions, and many other involved entities. Thus, it is fundamental to be able to identify fraud cases immediately and respond quickly.

Fraud detection refers to all methods and techniques applied for the identification of potential fraud cases, their investigation to determine whether the identified cases are actual fraud cases or not, and the response to them. Unfortunately, there exist a lot of different types of fraud and no unique mechanism that can identify all of them. Thus, auditors have to develop separate strategies to combat each type of fraud.

Advantages of Visualizations in Fraud Detection

The detection of fraud schemes requires an investigation of a vast amount of data that stems from many different anti-fraud systems with varying types of data. The auditors have to combine all the data and use statistical methods to uncover suspicious claims, which is time-consuming and inefficient in most cases.

Visualizations, on the other hand, can enhance the quick identification of relationships and significant structures and the detection of suspicious patterns that may hide in the amount of data. Besides the visual exploration, interaction with the data allows for a deeper understanding of the dependencies within the data changing over time.

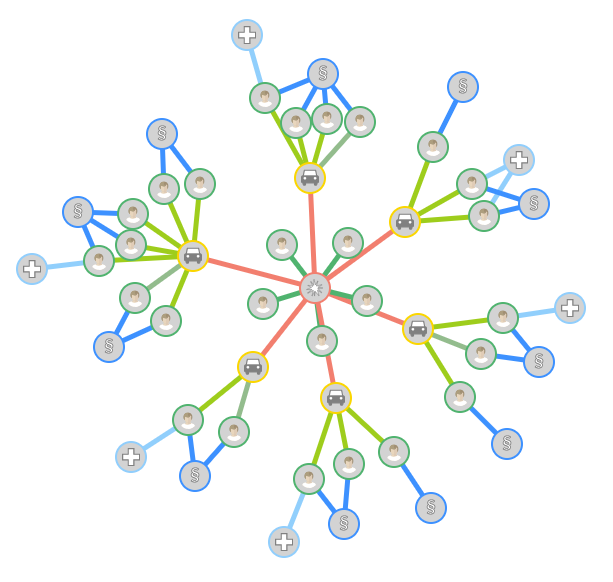

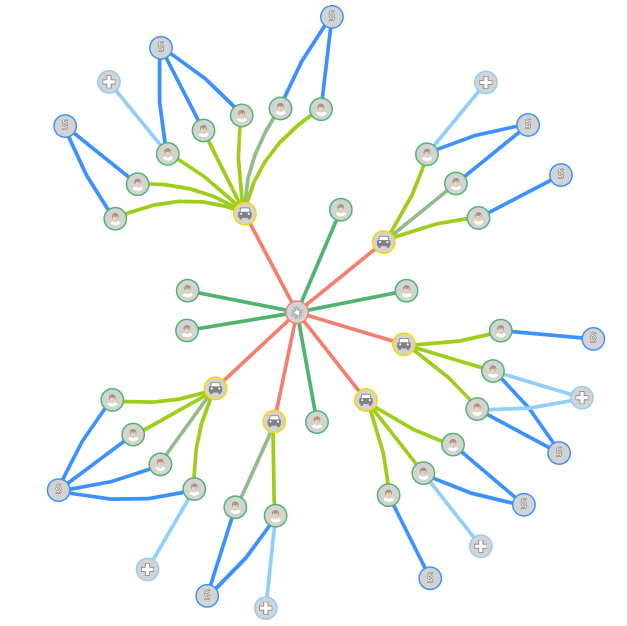

A typical pattern is the so-called fraud ring, i.e., several persons with specific properties that are involved in a series of events. For example, for fraud schemes like insurance fraud or first-party bank fraud, auditors look for potential fraud rings. These structures are perceivable in a suitable visual representation like a diagram. Therefore, it is easier to detected fraud cases through visualization rather than when trying to dig into a large number of database raws.

Challenges of Visualizations in Fraud Detection

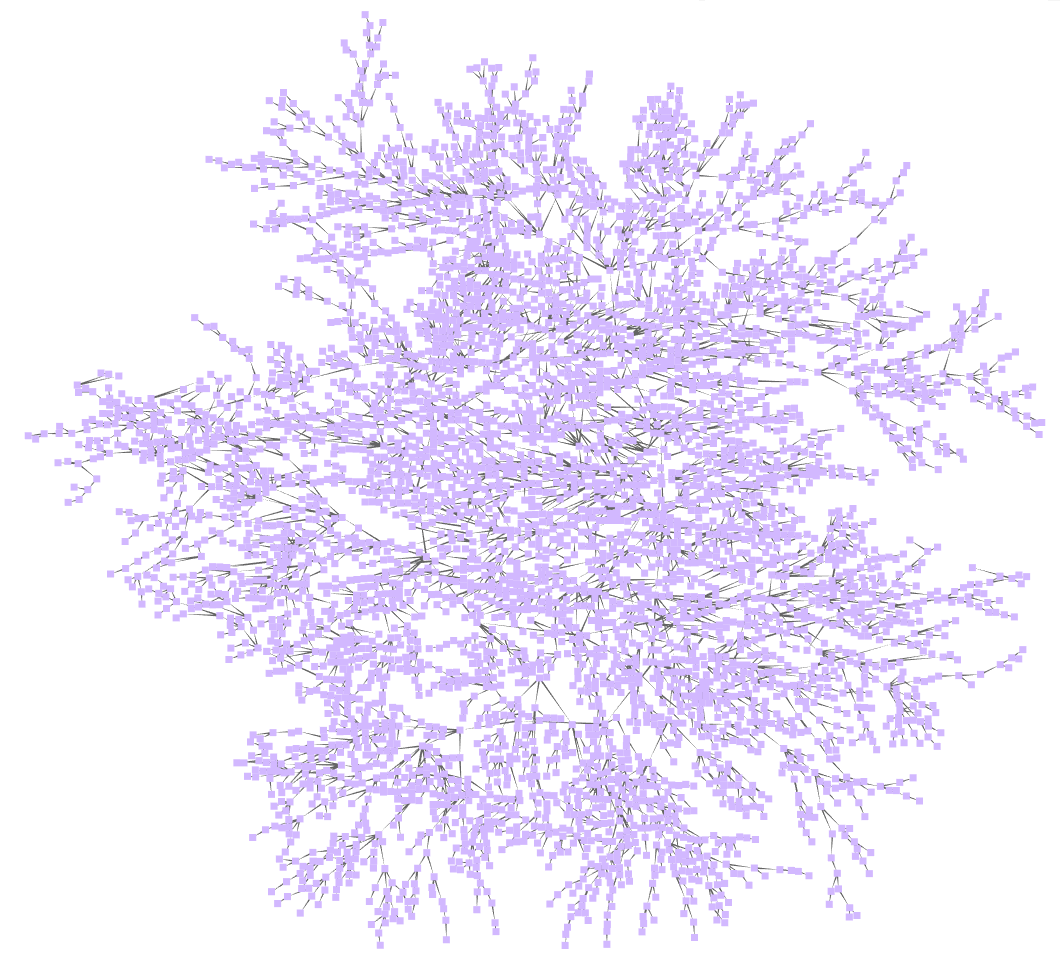

One of the most challenging tasks when using visualization for fraud detection is the sheer amount of data that is usually obtained by auditing systems. First, the auditor has to retrieve the data from the auditing system.

Visualizing such a large amount of data is the next challenge: the data needs a meaningful arrangement to create a human-readable representation. Providing suitable styling should enable users to identify different types of entities and relations.

Furthermore, high performance is essential to allow for interactive exploration of the data utilizing the benefits of graph database visualization.

How to Create Visualizations for Fraud Detection?

Since there exist a lot of different types of fraud schemes, it is clear that there is no unique solution that can detect all of them. Thus, a visualization meant to fight against fraud has to be adaptive to the needs of each auditor.

At first, it must not limit to a specific amount or type of data since the volume of the investigated data grows exponentially and comes from different sources. In some cases, it is also necessary to be able to support and visualize time-dependent data.

A sophisticated visualization should also provide the means for arranging the elements with multiple ways on the screen, i.e., using arrangements that reveal clusters or others that highlight hierarchical structures. Additionally, more sophisticated graph analysis algorithms should be supported for the detection of fraud schemes, e.g., cycle detection, or shortest paths.

Regarding the representation of the elements of the visualization, an auditor should be able to customize the look and feel of the graph elements based on his/her needs and be able to display additional properties of the graph elements. Finally, interaction is one of the essential operations when visualizing fraud data since it allows the auditor to explore its dataset.

Sophisticated Visualization of Fraud Detection using yFiles

A comprehensive visualization solution provides solutions for all the features discussed above should enable the auditors to gain more insight into the stored data. It can be tailored to specific requirements related to element visualization, element arrangement, or interactions.

Building such a visualization from scratch can be a challenging task. However, developers can save a lot of money, time, and workforce by using a software library that provides ready-to-use components for this task.

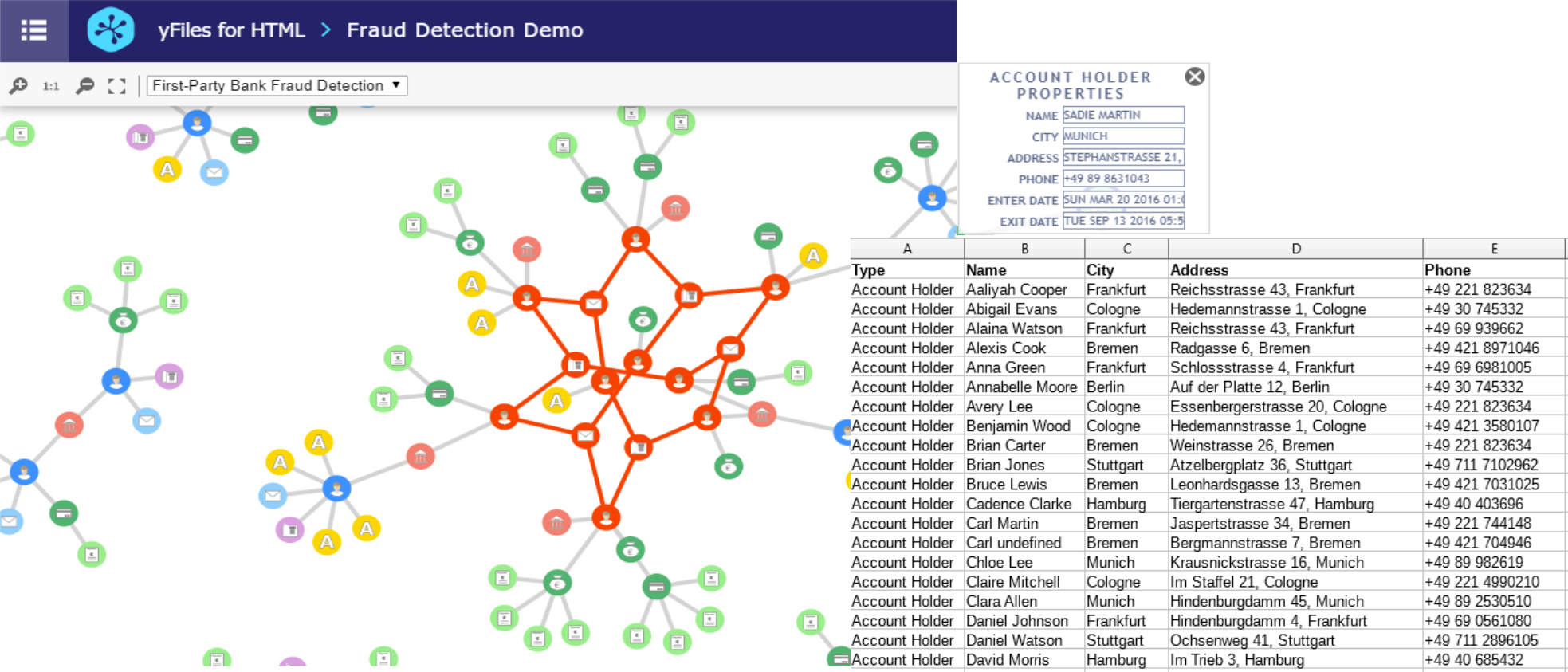

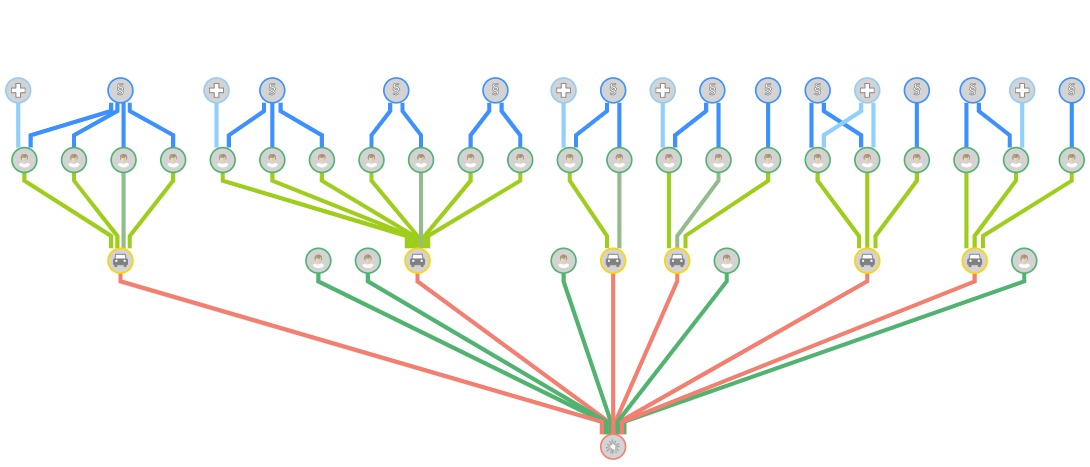

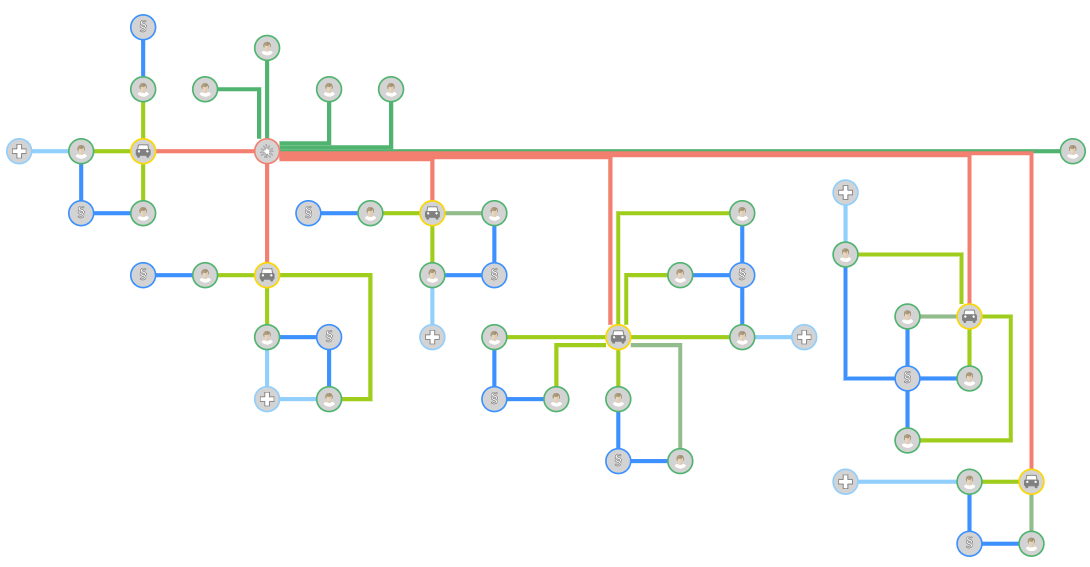

yFiles is a commercial programming library designed explicitly for diagram visualization and is a perfect fit for the challenges of fraud detection. The sophisticated layout algorithms of yFiles can comfortably transform the data in a readable, pleasing, and informative network. The different layout styles enable the user to intuitively identify structural characteristics of the data, such as cycles, connected components, or hierarchies.

|

|

Furthermore, yFiles comes with a multiplicity of graph analysis algorithms, e.g., cycle detection, centrality, clustering, and path algorithms, that can be applied to the data model to add more value to the data. The auditors can also implement custom fraud detection algorithms and integrate them easily with their visualizations.

An interactive application should provide much more functionality than a simple static representation. yFiles delivers a set of interactive features like:

-

Filtering reduces the number of displayed entities without any additional database queries.

-

Drill down helps to explore specific parts of the data.

-

Interactive modification of the graph using the mouse, the keyboard, and touch gestures help to explore the data.

-

Animations provide a pleasant user experience and help track structural changes.

-

Grouping combines similar or related items to reduce visual complexity.

yFiles comes with predefined styles that render graph elements and offer a broad set of properties to tailor the styling of graph elements for a specific use case or branding. It also supports creating an entirely custom visualization that fits the given data perfectly.

Examples and Source Code

With yFiles, fraud detection diagrams can be realized on all supported platforms. yFiles for HTML comes with a Fraud Detection Sample Application. This example provides a visualization of time-dependent data for the investigation of two different fraud schemes: first-party bank fraud and insurance fraud.

The source code of the Fraud Detection Sample Application is available on the yWorks GitHub repository and part of the yFiles for HTML package.